Schwartz and Co moderated the round table on the security of supply in natural gas at the gas conference organized by the AFG (#congresgaz2017) on 19 and 20 September 2017 in Paris. Schwartz and Co, Eni, Engie, Gazprom, Fluxys and IFRI shared their views on current important changes on the gas market, evolving challenges, and short and mid-term consequences on the security of supply in gas.

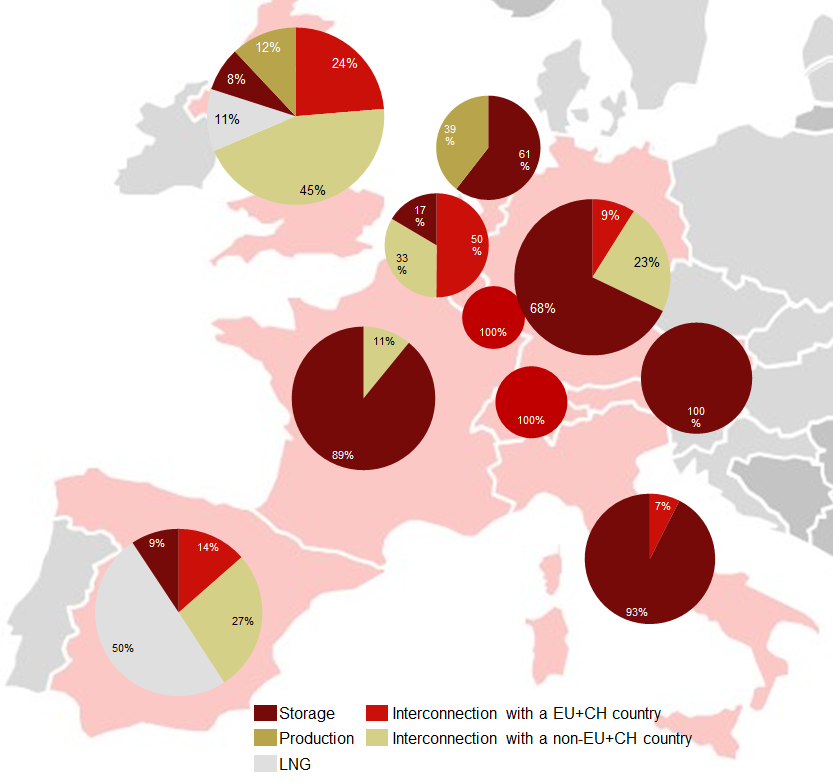

As an introduction, Hubert Gentou (Partner and Managing Director of Schwartz and Co for France) commented an extract of Schwartz and Co’s Oil & Gas Prices Outlook publication focused on gas security of supply in Europe and describing the tools used by gas market suppliers to respond to gas demand during 2015/2016 winter in Western Europe (see figure below).

Net seasonal flexibility supply by source and by country (Average Winter 2015/2016)

The study shows that the most used flexibility tools in Western Europe are storage, supply of gas from outside the EU (interconnections with non EU producing countries and LNG), and gas production inside the EU (Netherlands, United Kingdom).

An analysis of the consequences of North Sea production decrease and of Dutch B gas production decline highlights the following issues for 2020-2025:

- Europe will become more and more dependent on supply from outside the EU and on storage to meet winter needs, especially during peak periods.

- Europe cannot overlook the importance of storage in order to secure its gas supply (66% in volume of the supply tools used to meet winter specific needs).

- Due to uncertainties on the evolution of demand and on import sources, future investments in new transportation infrastructure will be questioned.

- Strengthened cooperation between European countries is critical to share available flexibility resources.

The presentation of these results launched the debate moderated by Hubert Gentou, with points of view exchanged by Daniel Fava (CEO Eni Gas & Power France), Iouri Virobian (President, Gazprom Marketing & Trading France), Sylvie Cornot-Gandolphe (Associate Researcher at the Energy Center of IFRI), Philippe Vedrenne (CEO Energie Global Management, Engie) and Thierry Deschuyteneer (Strategy and prospective studies director, Fluxys).

From left to right : Iouri Virobian (Gazprom), Sylvie Cornot-Gandolphe (IFRI), Daniel Fava (Eni), Thierry Deschuyteneer (Fluxys), Hubert Gentou (Schwartz and Co)

During the discussions, the speakers highlighted the following points:

- The new provisions on security of supply in natural gas passed by the European Parliament on 12 September 2017 are welcomed by the market players. The new regulation keeps the main points of Regulation (EU) No 944/2010 and introduces new principles to strengthen the cooperation between European countries such as: a solidarity mechanism dedicated to protected customers, reinforced regional cooperation and improved transparency.

- The European gas market is undergoing major structural changes. The changes in the geography of production and consumption restructure the gas flows in Europe. Whereas Dutch and North Sea production will strongly decrease in a relatively foreseeable manner, the trend in gas consumption within the EU is uncertain. The role of gas in the transition towards a carbon-free economy will depend on numerous factors such as gas, CO2 and coal prices, political guidelines, the development of renewable energy production and electricity storage technologies.

- Simultaneously, suppliers will reduce the share of long-term contracts in their portfolios and change their network capacity reservation towards more and more tailored short-term network bookings, resulting in more dynamic gas flows and more uncertain infrastructure reservations. This change is driven in particular by market rules and network codes defined at European level, which currently encourage short-term reservations. In a context of overcapacity with utilisation rate well below reservations, shippers will be forced by competition to focus their management of contracts on short-term and not to renew their long-term contracts.

These major foreseeable changes may result in a profound remodelling of the gas infrastructure industry over the coming years. These changes shall lead all the actors (suppliers, gas infrastructure operators, regulator, and investors) to review the sector in this new context.

Thus, while the French and more generally the European gas market players are currently focused on the economic and regulatory issues related to natural gas underground storage, issues related to the evolution of the economic model of other types of infrastructure, especially interconnections, will rapidly arise. Philippe Vedrenne outlined: “One may have to think about an implicit interconnection reservation system, as in the electricity sector. The issue of the economic model evolution may arise as soon as 2020-2025.” Echoing this statement, Jean-François Carenco, president of CRE, stated at the end of the Gas Conference that: “The end of long-term subscriptions on our main interconnections will be one of the key subjects for next natural gas transportation tariff period.”

As a result, regulators will have to rapidly address the questions of the remuneration of assets depending on their utilization, and on the definition of priority criteria by category of assets depending on security of supply criteria.

*********

About Schwartz and Co

Schwartz and Co is an international and independent strategy and management consulting firm specialised in energy, transport and water industry sectors. Schwartz and Co provides consulting services with strong business content in four domains: Strategy, Mergers & Acquisitions, Regulation & Market Models, and Operations Management. The firm is based in Paris, Luxembourg (group headquarters), Brussels, Lausanne, London and Beijing and operates throughout Europe, China and Africa. Schwartz and Co has carried out more than 250 consulting missions since the firm creation in 2009.

Schwartz and Co publishes an Oil & Gas Prices Outlook every year. This publication brings an expert view on the existing situation and outlook of oil and gas markets as well as quantified scenarios regarding the long-term evolution of oil and gas market prices in Europe. Schwartz and Co also releases a specific edition focusing on the Chinese gas market.